Stripe – Effortless Payment Processing for Your E-commerce Business

In today’s fast-paced e-commerce world, a smooth and secure payment experience is essential. Stripe, a top online payment processor, is popular among business owners for its simplicity, flexibility, and strong features. In this article, we’ll dive into how Stripe can help you streamline payment processing and boost customer satisfaction, ensuring your online store thrives in a competitive market.

Why Choose Stripe for Your E-commerce Business?

When picking a payment processor for your online store, several factors matter. Stripe stands out from competitors for these reasons:

- Ease of integration: Stripe’s well-documented API and extensive libraries make it a breeze to integrate with your e-commerce platform, whether you’re using Shopify, WooCommerce, or a custom solution.

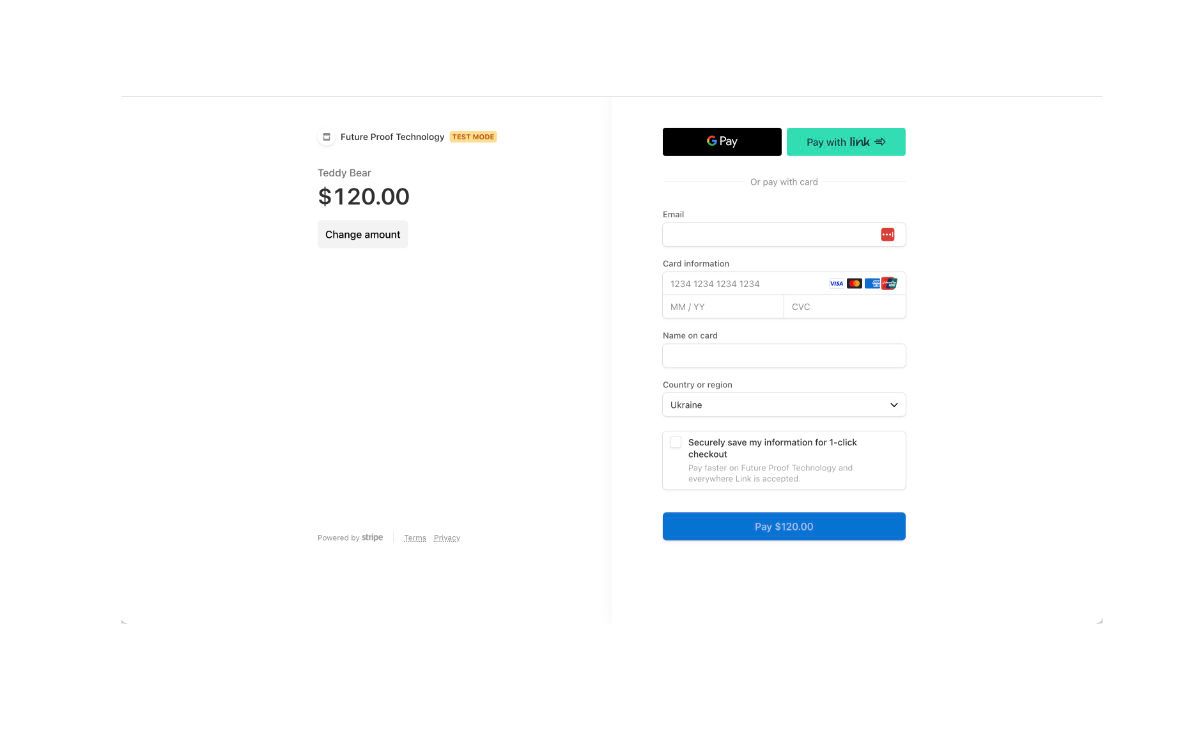

- Global support: Stripe supports over 135 currencies, allowing you to reach a broader customer base and cater to international markets with ease. Plus, it also supports popular payment methods like credit cards, debit cards, and digital wallets such as Apple Pay and Google Pay.

- Advanced security: Stripe adheres to the highest industry standards, including PCI DSS Level 1 compliance, ensuring your customers’ sensitive data is protected. It also employs advanced fraud detection tools to minimize risk and safeguard your business.

- Transparent pricing: With Stripe’s simple, pay-as-you-go pricing model, you only pay for successful transactions, making it a cost-effective choice for businesses of all sizes.

- Scalability: Stripe’s infrastructure is designed to handle large volumes of transactions, ensuring your payment processing remains smooth and reliable as your business grows.

Setting Up Stripe for Your E-commerce Store

Integrating Stripe into your e-commerce platform is easy. Here’s a brief overview of the steps involved:

- Create a Stripe account: Head over to the Stripe website and sign up for a free account. You’ll need to provide some basic information about your business, such as your company’s name, address, and tax ID.

- Activate your account: Before you can start accepting payments, you’ll need to activate your account by providing additional details, such as your bank account information and a description of your products or services.

- Choose your integration method: Stripe offers several options for integrating with your e-commerce platform. You can use one of their pre-built plugins or extensions for popular platforms like Shopify or WooCommerce, or you can create a custom integration using Stripe’s API.

- Configure your payment settings: Once you’ve integrated Stripe with your platform, you’ll need to configure your payment settings, such as specifying which currencies and payment methods you want to accept.

- Test your integration: Before going live, it’s essential to test your Stripe integration to ensure everything works as expected. Stripe provides a test mode that allows you to simulate transactions without actually processing payments.

Maximizing the Benefits of Stripe

To fully harness the power of Stripe and provide your customers with an exceptional payment experience, consider implementing these features:

- One-click checkout: Enable one-click checkout to store your customers’ payment information securely, allowing them to complete future purchases with just a single click.

- Subscription billing: If you offer subscription-based products or services, Stripe’s built-in subscription management tools can help you create and manage recurring billing plans with ease.

- Custom payment forms: With Stripe Elements, you can create custom payment forms that blend with your website’s design, ensuring a cohesive and professional look.

- Multi-currency support: Display prices in your customers’ local currency to create a more personalized shopping experience and potentially boost sales.

- Automated invoicing: Stripe’s invoicing feature lets you generate and send professional invoices to your customers, streamlining your billing process and reducing manual work.

- Connect platform: If you run a marketplace or platform with multiple sellers, Stripe Connect can help you manage payments between buyers and sellers, handle complex transactions, and even automate payouts.

- Analytics and reporting: Stripe offers comprehensive reporting tools to help you track and analyze your sales, refunds, and disputes. By using this data, you can make informed decisions to optimize your e-commerce strategy.

Conclusion

Incorporating Stripe into your e-commerce business can greatly improve your payment processing capabilities and boost customer satisfaction. With its easy integration, global support, top-notch security features, and scalability, Stripe is an ideal choice for businesses looking to provide a seamless and secure payment experience for their customers.

By making the most of Stripe and implementing features like one-click checkout, subscription billing, custom payment forms, and multi-currency support, you can create a tailored and user-friendly payment experience that encourages customer loyalty and drives sales.

In today’s competitive e-commerce landscape, a reliable and efficient payment processor is a key component of your online store. Don’t miss the opportunity to empower your business with Stripe, a trusted and proven solution for effortless payment processing.